Utility-scale solar is making such inroads into the energy business in the US that utilities are no longer fighting it, with large-scale solar likely to be competitive even if current tax credits are removed.

That is the assessment of SunPower, one of the biggest solar module manufacturers and project developers in the US, which this week bought out the 1.5GW solar portfolio in the US built up by Australia’s Infigen Energy.

In a conference call accompanying its second quarter results, SunPower president and CEO Tom Werner said large-scale solar barely accounted for 1 per cent of total generation in the US, but it had huge potential, even if the investment tax credit (ITC) was removed in 2017.

That’s because of the declining costs. Werner pointed to one contract below $US50/MWh. Others have gone below $40/MWh.

“If you do the math on that and you project post-ITC, and you continue protecting our cost down and performance increases in our systems, that’s where we get our confidence in a potential post-ITC world,” Werner said.

“So, we think that our solar energy is interesting to utilities already post-ITC, assuming there is a post-ITC.”

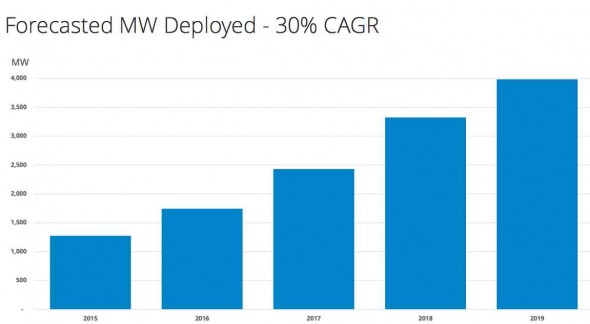

Costs for large-scale solar in the US are falling rapidly, helped by cheap finance from new asset classes and vehicles that analysts say will result in more investment than the oil and gas industries. Werner’s confidence is reflected in the company’s forecast for solar deployment over the next four years, growing at 30 per cent compound rate.

SunPower also pointed to the modular nature of large-scale solar farms, which cut costs, particularly expensive labour costs, and improved efficiencies in solar modules.

The US is not the only market approaching wholesale price parity for solar. A recent report from Deutsche Bank indicated that India was about to reach the same level, an assessment reinforced by the local offshoot of Fitch Ratings. Deutsche believes that investment in large-scale solar will outstrip that of coal generators within a few years.

China has also set huge solar targets. SunCorp said this was being driven by the economics of solar and the need to improve air quality. Deutsche Bank expects China to lift its 100GW solar target for 2020. It expects around 120GW to be installed.

Solar PV is already beating new-build fossil fuels in emerging markets such as Chile, Africa and the Middle East. But the fact that it is likely to take off dramatically in the world’s biggest energy markets underpin forecasts, including from the International Energy Agency, that solar will become the dominant energy sources within decades.

SunPower development head Howard Wenger told the conference call that US utilities are “no longer really fighting solar” – they are trying to figure out a solution to combine solar with the traditional utility business.

One of the emerging new models, Werner suggested, is community solar, or shared solar.

NRG Energy, one of the biggest utilities in the US, this week announced a 1MW shared solar project to service about 200 homes in Massachusetts.

NRG Energy has more than 100MW of shared solar projects already in the works in both Massachusetts and Minnesota, and is actively seeking to expand into other markets.

Steve McBee, the head of NRG Home, says shared solar could be a huge business opportunity. That’s because 73 per cent of people NRG approaches can’t put solar on their roofs – perhaps because they don’t own their home, have structural issues, or have too many obstructions that would limit the system’s output.

“If our customers want solar, they ought to be able to get it, and the only thing standing in their way is that there isn’t a regulatory scheme worked out that will allow that to happen,” McBee told Greentech Media.

“The technology is there, the market demand is there, the cost is right – we’re just waiting on a policy signal. That frustrates me.”

SunPower’s Werner said there are a number of different models that his company was working with utilities.

Parkinson, Giles. “Large Scale Solar near Parity in World’s Three Biggest Markets.” RenewEconomy. RenewEconomy, 29 July 2015. Web. 31 July 2015.